Hello friends, do you also want to earn monthly income from the stock market, then today’s information is especially for you.

Now you might be wondering how monthly income is possible from stock market but it is possible with the help of swing trading in which you invest money for 1 to 2 weeks and when you get your target then make money by selling.

But you have to find such stocks which can give good returns in 2 weeks and this also takes a lot of time, that is why today I have brought 3 such stocks for you which can give good returns in the coming 2 weeks.

3 Stocks for next 2 weeks

Let us know these stocks in detail.

JUNILANT INGREVIA ABOUT : Jubilant Ingrevia, a global integrated Life Science products and Innovative Solutions provider serving, Pharmaceutical, Nutrition, Agrochemical, Consumer and Industrial customers with our customised products and solutions that are innovative, cost-effective and conforming to excellent quality standards.

Jubilant Ingrevia’s portfolio also extends to custom research and manufacturing for pharmaceutical and agrochemical customers on an exclusive basis.

FUNDAMENTALS HIGHLIGHTS

| Market price – 6906 | Current price – 436 | High/low – 525/350 |

| Stock P/E – 33.6 | Book Value 170 | Dividend yield 1.15% |

| ROCE 16% | ROE 21.2% | Face Value 1.00 |

Technical analysis

This is the graph of Jubilant Ingravia Company till 8th February 2024 in which we can see that two blue coloured trend lines have been drawn on the support and resistance of the graph and here the yellow line is the simple moving average and the red, green box is the stop loss and target point.

👉🏻👉🏻Know about Adani share price👈🏻👈🏻

As you can see in the image, every time the market comes to its support level and from there then to the resistance level, the market is reversing by touching the breakout.

During this time, our entry price can be the top of the last green candle (436.55) and stop loss can be the bottom of the same green candle (419.30) and the target price can be kept at (514).

EDELWEISS FINSERV ABOUT : Incorporated in 1995, Edelweiss Financial Services Ltd provides Investment Banking and Advisory Services and holding company activities

FUNDAMENTALS HIGHLIGHTS

| Market Cap 6597 Cr. | Current Price 71.4 | High/low 87.8/29 |

| Stock P/E 17.5 | Book Value 46.7 | Dividend yield 2.07% |

| ROCE 9.86 | ROE 5.18% | Face Value 1.00 |

Technical analysis

This is the graph of Edelweiss Financial Services Ltd till 8th February 2024 in which we can see that two purple coloured trend lines have been drawn on the support and resistance of the graph and here the yellow line is the simple moving average and the red, green box is the stop loss and the target is the point.

As you can see in the image, every time the market comes to its support level and from there again to the resistance level, the market reverses by touching the breakout.

Meanwhile, our entry price can be at the top of the last green candle (71.40) and the stop loss can be placed at the bottom of the same green candle (68.15) and the target price can be placed at (87.65).

LT FOOD LTD. ABOUT : LT Foods Limited was incorporated in the 1980’s. It is primarily engaged in the business of milling, processing and marketing of branded and non-branded basmati rice and manufacturing of rice food products in the domestic and overseas market.

It is also engaged in research and development to add value to rice and rice food products. The Company’s rice product portfolio comprises brown rice, white rice, steamed rice, parboiled rice, organic rice, quick cooking rice, value added rice and flavoured rice in the ready to cook segment.

The Company’s subsidiary, Nature Bio Foods Limited (NBFL) drives the ingredient based organic food segment. It has emerged as a trusted brand, offering authentic organic ingredients to consumers across the markets of the US and Europe.

FUNDAMENTALS HIGHLIGHTS

| Market Cap 6481 Cr. | Current Price 193 | High/low 235/90 |

| Stock P/E 11.3 | Book Value 88 | Dividend yield 0.51% |

| ROCE 17.1% | ROE 16.8% | Face Value 1.00 |

Technical analysis

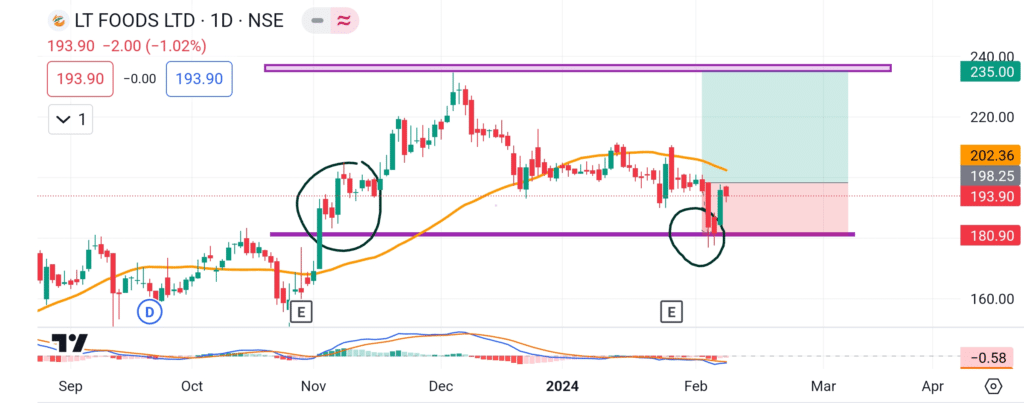

This is the graph of LT FOOD Ltd till 8th February 2024 in which we can see that two purple coloured trend lines have been drawn on the support and resistance of the graph and here the yellow line is the simple moving average and the red, green box is the stop loss and the target is the point.

As you can see in the image, first the market came near its breakout and touched it and went back up and after touching the resistance it came back to the support level after which a big green candle is formed which indicates the market going up.

Meanwhile, our entry price can be placed at the top of the last green candle (193.90) and the stop loss can be placed at the bottom of the same green candle (180.90) and the target price (235).

NOTE – Through this information, we do not force you to buy stocks. If you suffer financial loss after investing in them, we will not be responsible for it, This information is only for education purpose. 👈🏻👈🏻

Conclusion

Hope friends, you would have liked today’s information “Best 3 Multibagger Stocks For Next 2 Weeks”. Through this information, we have told you 3 stocks for swing trading which can give good returns in 2 weeks.

But investing is your own decision, we do not force you for it. To get more information related to this, join finbz.